Frequently Asked Questions

There is no such thing as a dumb question, but there certainly are common ones! Below are some of the inquiries we receive most often which may help you quickly resolve a question you have too.

Please visit our Locations & Hours Finder.

UCB provides you with access to numerous ATM locations throughout all our communities, all free to use for any United Community Bank customer! To find one near you or your destination, please use our interactive Locations & Hours Finder. We are also part of the MoneyPass® Network! Visit moneypass.com to locate approximately 40,000 nationwide MoneyPass® ATMs to avoid surcharge fees when traveling.

Please contact our dedicated E-Services Team immediately, toll-free at 844-637-2411 Monday - Friday 7 a.m. - 6 p.m. CT and Saturday 8 a.m. - 12 p.m. CT. If it is outside these hours, please call 877-328-2016 to report your card lost or stolen.

You may also use Card Controls to help protect a lost card. Simply login to your Online or Mobile Banking* experience and select "Cards" to turn your debit card "off" right away. This way, you can easily turn it back "on" again once you find it. This will help you protect it from any unauthorized use while you attempt to locate it.

If you know your PIN and would like to change it, you may do so using Card Controls in your Digital Banking* experience. Simply select "Cards" and "Set PIN" under Manage Card. You may also call, toll-free, 800-992-3808 and follow the prompts. However, if you have forgotten your PIN or misplaced a new PIN, you will need to visit your nearest location for assistance. This is for your security and account protection, so please be sure to bring your ID and we will be happy to help you select a new PIN.

Please visit the lobby of one of our banking centers. Bring your ATM or Debit Card, along with a valid photo ID to verify your identity. You will then be able to choose a new PIN that we will help you activate.

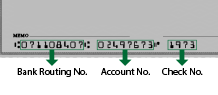

If you are trying to establish direct deposit or set-up an automatic withdrawal, along with your account number, you will also need to supply our United Community Bank Routing or ABA Number: 071108407. This nine-digit number is also located on the bottom of each of your checks. It is the first series of numbers prior to your account and check numbers.

Yes! Your deposits are fully insured up to at least $250,000 at all of our United Community Bank branches. United Community Bank (FDIC Certificate No. 19459) also operates bank branches as Brown County State Bank, Golden State Bank, Marine Bank & Trust, Mercantile Bank, Farmers State Bank of Camp Point, Liberty Bank, and United Commonwealth Bank. Visit with our Mercantile Bankers for details on your covered accounts. We will help you understand and maximize your deposit insurance coverage. For more information and resources, read the following article in our Financial Resource Library: FDIC Insurance.

You may not exceed $5,000.00 (or your available balance if less than this amount) in point-of-sale signature and PIN-based transactions in a 24-hour period. If you are anticipating a large purchase or group of purchases that will exceed this amount in one day, please contact your E-Services Team, toll-free at 844-637-2411 to request a temporary daily limit increase.

You may withdraw up to $500.00 from an ATM each 24-hour period.

Contact us immediately during business hours and let us know that your checks are lost. Inform the bank of any checks you have written that have not yet been cashed. You may also place a stop payment on each check that is unaccounted for.

A stop payment order may be placed for checks and certain automatic debits. If the eligible debit item in question has not cleared or been posted to your account, you may request that payment be stopped. A fee applies for each stop payment order, and once placed, the order remains in effect on your account for six months.

Checks: You may request to stop payment of a check in your Digital Banking account or by contacting your nearest location. To request stop payment of a check in your Digital Banking* account, use the drop-down menu in the upper right-hand corner of your screen, select Accounts then Stop Payment. Next, review the disclosure to continue to the form, and once completed, Submit the form to place your request.

Automatic Debits & Bill Payment Items: To request stop payment of an automatic withdrawal or bill payment item, please call or visit us for assistance. To stop an automatic withdrawal, please contact us at least two business days prior to your expected payment withdrawal date.

Debit Card Transactions: You may not stop payment on debit card purchases and other card transactions that have already been authorized and/or posted, however, you may dispute inaccurate, duplicate, or fraudulent transactions that have occurred within 60 days. Please contact us to initiate this process.

If you are locked out, please call our dedicated E-Services Team, toll-free at 844-637-2411. We will ask for your Login ID as well as several other security questions to verify your identity. If you are locked out and know the correct password, we can reset it and your access will be restored.

If you have forgotten your password, first try to reset it by selecting the "Forgot Password" link on the login screen. Then enter your Login ID and click submit. You will then receive an email at your registered email address with instructions to complete the password reset process. If you do not receive the email or need additional assistance, please contact our E-services Team, toll-free at 844-637-2411 for assistance.

Please call our dedicated E-Services Team, toll-free at 844-637-2411. We will first ask you a series of questions to verify your identity. We will then be able to reset your access with a temporary PIN.

To activate a new Debit or Credit Card come into your nearest branch or call the number on the back of your new card.

Typically the organization that is paying you will have direct deposit instructions. Ask for a direct deposit form. If your employer offers direct deposit, ask the Human Resources contact what steps are necessary. To arrange direct deposit into your Mercantile account, you will need our ABA Number or Routing Number: (071108407). The next number you need for your direct deposit instructions is your account number. Your account number is most likely the account number you use every day. However, you may have a different account or even multiple accounts you would like to use for direct deposit. Some companies require that you submit a voided check or other documents in order to set up direct deposit. This allows them to make sure that all information is entered correctly, and it can be a security measure. Finally, you may need an address of the receiving institution in order to set up direct deposit. This may not make sense because they're sending the money electronically but this is a typical requirement.

It is very easy to set up an automatic savings plan. If you currently have direct deposit through your employer you will find the easiest way to establish this is to have part of your paycheck directly deposited into your savings account as well. It doesn’t matter if it is $10 or $500, simply having this happen automatically will ensure money is saved every time you are paid.

If you don’t have direct deposit there is still an easy option available if you do your banking at a local branch. Typically your bank can link checking and savings accounts together and establish automated transfers between accounts at a regular interval that you select. So if you cash your paycheck every other Friday you could establish an automatic transfer of a set amount of money from checking to savings to coincide with this deposit.

Yes, but other banks may charge you fees to use their ATMs. To avoid other banks ATM fees, our United Community Banks provide you with access to numerous ATM locations throughout all our communities, all free to use for any Mercantile customer! To find one near you or your destination, please use our interactive Locations & Hours Finder.

We are also part of the MoneyPass® Network! Visit moneypass.com to locate approximately 40,000 nationwide MoneyPass® ATMs to avoid surcharge fees when traveling.

* Your cellular provider's data and text messaging rates may apply to mobile Digital Banking Services including Mobile Banking, Mobile Deposit, Mobile Wallet, Zelle®, Card Controls, and Beacon Alerts activities.